Financial literacy is the ability to effectively manage a variety of financial skills, such as personal finance management, budgeting, and investing. Financial investments and services have recently become widespread among people of all economic backgrounds.

India’s financial literacy rate among its young and adult population has been growing due to various factors including the recent advancement in technology and media coverage. The government of India and various regulators are constantly working towards growth by implementing financial literacy courses, workshops and schemes. From mobile banking to online payments and insurance; the country has a huge number of online financial services users. This helped improve India’s financial literacy as the awareness and ease of insurance and banking increased. Number of transactions with respect to digital payments in India grew 5x from 1,004 crores (10.04 billion) in 2016-17 to 5,554 crores (55.54 billion) in 2020-21. Furthermore, the value of fintech transactions is expected to rise at a CAGR of 20% to US$ 138 billion in 2023 from US$ 66 billion in 2019.

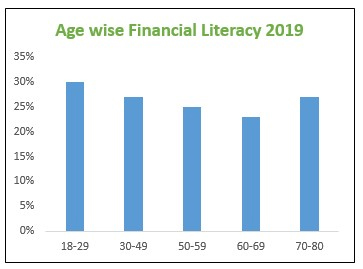

Source: National Centre for Financial Education report, 2015 & Financial Literacy and Inclusion in India Survey Report, 2019

Financial literacy is one of the biggest assets of any country as it is directly proportional to the economic growth. The significance of financial literacy in India are as follow:

Reaching out to rural sections and working on their development can be achieved through financial literacy. This can be achieved by making people more aware about the available resources and right way of utilizing them.

Based on an RBI study, 42.9% of population borrowed money from informal sources and pay higher interests. A strong financial education can help small traders make informed decisions and make the best use of available resources.

The launch of Pradhan Mantri Jan Dhan Yojana has led to an addition of 280 million new bank accounts. These accounts have led to an ease in doing business and has also promoted cashless transactions to a great extent.

MSMEs contribute to 29% of India’s GDP with 50% of the exports coming from this sector. Financial literacy can help small businesses grow and even bring new businesses to the market.

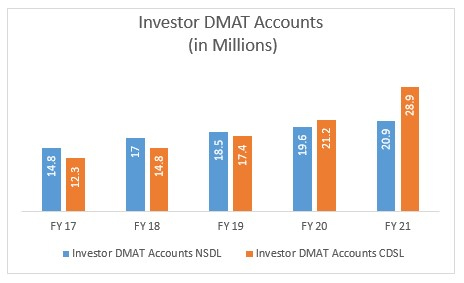

Retail participation in the Indian stock market has increased dramatically over the last two years, as more first-time investors have shifted their focus from traditional means of investing and entered the stock market in search of higher returns. The pandemic-caused lockdown and subsequent work-from-home with high internet penetration fueled their enthusiasm even more. Between April and November 2021, the two depositories, Central Depository Services (CDSL) and National Securities Depository (NSDL) added 28.6 million new accounts.

Source: Business Standard

Social media has a huge impact in spreading financial literacy in India. It was one of the biggest influencers of rise in investment during the pandemic. Many stock market training academies, YouTube channels and websites were founded during this period. The top 15 Indian YouTube channel focusing on equity markets have a subscriber base of more than 13 million. An increase in internet penetration and popularity of these mediums, triggered a rise in popularity of investment across India. Many people from different age groups began investing in equity markets and mutual funds. The retail investors’ share in cash market turnover increase from 39% in 2019 to 45% in 2020.

Strengthening financial inclusion in India has been an important agenda of the government and the various regulatory bodies such as: RBI, SEBI, IRDAI, PFRDA. Efforts have also been taken to spread awareness and increase financial literacy among small businesses. Listed below are few such initiatives taken by respective regulatory authority:

RBI being the money market and the banking regulator has launched basic financial education as well as sector focused financial education. These include, financial literacy guides, diaries and posters covering the tenets of financial wellbeing such as savings, concepts of interest, time value, inflation etc. To aid businesses, ATM’s, payment systems, Ponzi schemes, financial awareness messages etc. are some of the other contents covered.

SEBI also focuses on enhancing basic financial education and sector wise financial education. Being the Indian capital and securities market regulator, it also arranges events such as the World Investor Week and mass media campaigns. It also has a dedicated investor website.

Like the other regulators, IRDAI also works on content development by creating brochures, handbooks etc. It has also created mandatory board approved policy for insurers and arranges various seminars and quiz programs.

PFRDA has dedicated website called ‘Pension Sanchay’ launched in 2018. This website aims at increasing financial literacy from retirement perspective.

In addition to the above, the government of India has also implemented several schemes in order to increase financial inclusion such as, Pradhan Mantri Jan Dhan Yojana, Jivan Jyoti Beema, Atal Pension Yojana etc. These schemes are introduced for the ease of banking services, awareness, and general insurance awareness. In addition to this, the government arranges several financial literacy programs like financial education for children, retirement planning, commodity future markets and insurance for school students to educate and spread awareness among the young population.

Despite having a population of 1.3 billion people, about 76% of the adult population are yet to improve upon their understanding about basic financial concepts. India has the potential to be among the top financial literate country in the world as 27.6% of its people between the age group 25-44 continue participating in the financial inclusion program through financial education. This rate could expand by more than 20% in the next two decades, if the youngsters within the age group 10-19 are also provided proper financial education. This group constitute about 21.8% of India’s population. Financial abilities could lead to general economic growth and increase the standard of living. India’s work force combined with strong financial education can take the country to great levels. A financially savvy India would be a big global influence.